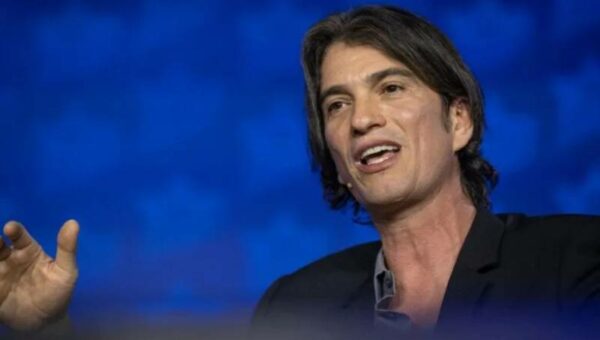

Not at all like WeWork’s misfortunes, previous CEO and co-founder Adam Neumann has seen an alternate monetary direction.

Collaborating monster WeWork petitioned for Section 11 bankruptcy in New Jersey, denoting an uncommon fall after a transient ascent to become one of the US’ most important new companies. At the hour of declaring financial insolvency, the organization’s valuation tumbled to $45 million from its pinnacle valuation of almost $47 a long time back.

The organization’s stock has plunged by more than close to 99% since its doomed first sale of stock (Initial public offering) in the midst of analysis of prime supporter Adam Neumann’s authority style and difficulties presented by the Coronavirus pandemic to the collaborating model.

Dissimilar to WeWork’s misfortunes, previous President and fellow benefactor Adam Neumann has seen an alternate monetary direction. Regardless of the organization’s troubles, he encountered a huge expansion in his riches, with a significant part procured during the company’s Initial public offering process directed through a specific reason securing organization (SPAC).

As a component of the SPAC bargain, the 44-year-old got a detailed $480 million of every 2021 for half of his excess stake in WeWork, close by an extra $185 million connected with a non-contend understanding and $106 million from a settlement.

Altogether, Neumann collected around $770 million in real money from the 2021 SPAC process, regardless of done holding an administration job at WeWork.

Notwithstanding the insolvency documenting and his partition from WeWork starting around 2019, that’s what neumann trusts, with the right technique and group, WeWork can effectively rearrange and flourish.

“As the co-founder of WeWork who spent a decade building the business with an amazing team of mission-driven people, the company’s anticipated bankruptcy filing is disappointing. It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before,” he said in an explanation.

“I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully.”

WeWork’s ascent and fall

WeWork, helped to establish by Adam Neumann in 2010 during the underlying funding (VC) blast, immediately developed into a worldwide venture, raising billions and multiplying income year-on-year. At a certain point, it held the title of the most significant startup in the US.

In August of this current year, WeWork’s portions plunged to approach zero, with the organization communicating huge uncertainty about its capacity to stay in business as it wrestled with mounting misfortunes.

The SoftBank-supported organization has stood up to corporate administration issues and confronted examination over Adam Neumann’s initiative style.

A progression of high-profile chief flights, remembering President Sandeep Mathrani for May and three load up individuals in August 2023, further intensified the organization’s inconveniences.

Japanese combination SoftBank, a significant WeWork financial backer, has put significant totals in salvage endeavors, however the organization’s monetary battles endure.