Passive income is an excellent way to supplement one’s current income, raise capital for expanding a business, and create financial streams to secure enough money for retirement.

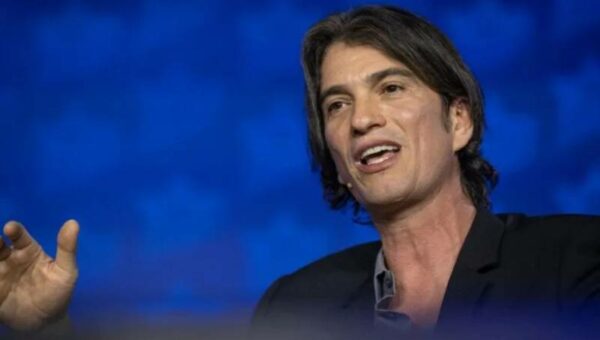

Damon Woodward, a high-profile real estate investor and CEO of Leadway Holdings Ltd. and Blackcard Elite Academy Ltd., agrees that it is essential to ensure two types of income: active and passive.

At the start of the year, Damon purchased more than ten properties to flip. However, he also owns 67 real estate units that he renovates and holds as his passive income source. “You need the fast money and the passive money,” Damon says. “Passive income and cash flow are essential to building long-term wealth.”

Damon loves sharing advice with aspiring entrepreneurs, so he took some time to explain the most efficient strategies to ensure passive income in real estate.

Prepare for the Real Estate Industry

Without a solid educational foundation, entering the real estate industry is likely to lead to lost money and failed deals. Many newbie real estate investors don’t realize that being a landlord is a tough business that should not be taken lightly. Damon strongly advises investing in knowledge and education first and then investing in business.

Gain Some Experience First

“You need to learn how to sell and make $100,000 per year for two years on straight commission before you are qualified to scale your own business,” is the single best piece of advice that Damon Woodward has ever received. It is this very advice that put Damon on the path to tremendous success. Damon strongly believes that it is impossible to succeed without proper education and background experience.

Secure Enough Cash Flow

As already mentioned, an aspiring real estate investor should always have two types of income—fast money and passive money. When it comes to real estate, all investors should strive to work on their passive money source while still earning steady cash flow.

Keep an Active Role in Management

All aspiring real estate investors should make sure to actively manage their property managers by keeping in regular contact with tenants and providing regular care for them to ensure proper care and maintenance are taking place. Proper management of a property can help reduce tenant turnover, improve property value, and prevent avoidable repair costs.

Thoroughly Screen All Tenants

The best strategy to maximize passive income from real estate is by leasing the property to ideal tenants. Through property damage or an expensive eviction process, a bad tenant can turn out to be much more expensive than any vacancy. That is why Damon suggests working with a credible property management company to properly screen tenants and check their records and references.

Are you interested in more tips? Make sure to check out Damon’s social media accounts. He frequently shares excellent advice and strategies for aspiring real estate investors on his Instagram (@damonwoodward3). Damon also posts educational videos on his YouTube channel regularly. And, if you’re in need of proper education in real estate investing, choose one of the fantastic programs offered at Blackcard University.