Amazon will probably leave a few failures afterward as it dispatches Amazon Care, the restorative facility it’s steering for its Seattle workers.

In what ought to send shivers through the retail social insurance advertise, Amazon (NASDAQ:AMZN) stepped into the business by reporting the production of Amazon Care in September.

The experimental run program, presently accessible for its Seattle workers and their families, merges telemedicine with in-home or in-office visits.

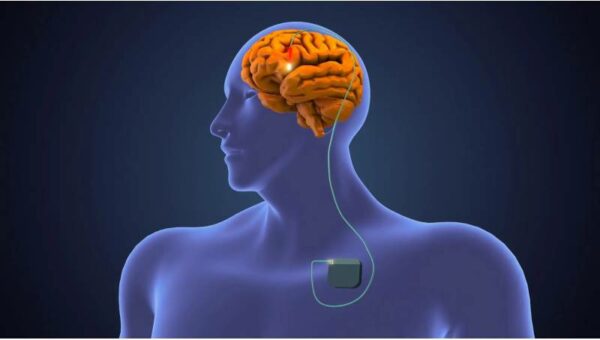

With the new help, representatives can have video visits by means of the application with specialists, nurture professionals, or enrolled attendants. They can content an attendant and find solutions in minutes. In the event that the specialist or their wards need face to face care, a medical caretaker will go to their home or office. Amazon Care members additionally get their professionally prescribed medications filled through Amazon; they can be conveyed or got at a partaking drug store.

Amazon is collaborating with Oasis Medical Group to give specialist and attendant access to its Seattle workers. That empowers the Seattle web based business goliath to lighten worries that a business approaches its representatives’ restorative archives.

A $3.5 trillion market for Amazon to seek after

The new help is the most recent Amazon exertion to enter the social insurance showcase, disturb it, and (in the event that it has its direction) at last overwhelm it. It bodes well that Amazon would focus on human services. It’s a $3.5 trillion market that many feel needs a redesign.

While telemedicine has begun to change how we collaborate with specialists and medical attendants, it’s still a long way from being the standard. Long hold up times, exorbitant deductibles, and out-of-pocket costs are as yet the ordinary course of getting to therapeutic consideration in the U.S. By utilizing computerized innovation to help wiped out workers, Amazon is doing what it is truly adept at doing: cutting the expenses related with the business and carrying better assistance to scores of purchasers.

Amazon fabricated its business on doing directly by the purchaser, and it’s currently expanding that mantra into an industry needing change.

Amazon Care is a characteristic advancement for Amazon’s endeavors in the human services advertise. It began in January 2018, when Amazon declared an association with JPMorgan Chase and Berkshire Hathaway to offer workers restorative protection. That association, which still has discharged couple of insights regarding its arrangements, is currently called Haven Healthcare. The following push came when Amazon burned through $753 million to buy online drug store PillPack in June 2018.

Amazon is additionally purportedly chipping away at remote earbuds that will have Alexa, its voice-initiated advanced partner, worked in. The earbuds, expected to be called Puget, will have an accelerometer and can screen how far an individual strolls/runs and the quantity of calories consumed, in addition to other things. In the event that will stamp the principal bit of equipment Amazon creates concentrated on the medicinal services market to leave its wellbeing and health unit. That unit is entrusted with discovering errands for Alexa in the medicinal services industry.

Amazon Care a testbed for what’s to come?

Opening a human services facility bodes well for Amazon. It gives it a lab to test new items and advanced administrations on its representatives, something it has been known to do previously. On the off chance that it’s a hit with its workforce in its main residence, it’s not all that a lot of a stretch to expect Amazon will grow the program.

News that Amazon is entering the telemedicine showcase previously burdened stocks. In view of the Amazon Care news, portions of Teladoc Health (NYSE:TDOC) declined as financial specialists measured the effect Amazon will have on its business. One examiner contended the web based business monster is probably going to cooperate with the telemedicine organizations as opposed to make them bankrupt. Be that as it may, that didn’t prevent the stock from terminating a week ago’s exchanging session down.

CVS Health (NYSE:CVS) and Walmart (NYSE:WMT) could likewise lose if Amazon Care is offered to the overall public. CVS works its MinuteClinic, with areas around the nation, and Walmart as of late opened another Walmart Health facility in Dallas, Georgia. The retailer empowers individuals to make arrangements on the web and gives patients access to essential consideration administrations, incorporating help with emotional well-being issues, at a decreased expense. Walmart is attempting to stand apart from the other social insurance facilities by offering every one of the administrations and medicines you would get from an essential consideration specialist.

CVS is likewise emptying huge amounts of cash into its in-store facilities, with designs to have 1,500 HealthHUB areas by 2021. These new centers give medicinal services administration, on-request computerized wellbeing devices, and customized care. Walgreens Boots Alliance (NASDAQ:WBA), as far as it matters for its, has in excess of 370 medicinal services centers at stores the nation over.